One day in the near future, you’ll walk into a shoe store. A quick scan of your retina from the over-the-door camera as you stroll past, double-checked against your heat signature and gait analysis, verified by your OCTO-encrypted blockchain gateway and confirmed with your semi-autonomous personal assistant … and by the time you reach the counter, the very shoes that you’d been dreaming of are waiting for you (in your size and preferred color, of course). You’ll slip them on and trot out the door, acknowledging the haptic credit receipt in your wrist, ready to face the day in your new kicks.

Frictionless payments may be your company’s dream—and this future isn’t so far off. A number of these elements mentioned above are available right now. The movement toward easier payments began digitally. Think of Amazon’s 1-Click ordering. Renting movies directly through your Smart TV. Targeted ads in your Instagram feed. But the move toward real-world frictionless payments can be traced to Amazon Go. With a video in 2012 and a working store in 2016, Amazon Go ushered in the era of frictionless payments, and products and services continue to spring up to support it. As frictionless becomes more attainable, it also feels sort of inevitable.

However, it’s important to note that frictionless payments may not be the dream of all your customers. For some friction-friendly people, it might even be a nightmare. Fact is, not everyone wants to go frictionless today. Some people are not ready to change the way they pay. Some people like to talk to checkout personnel. Some don’t have smartphones. Some do not have credit cards. Some distrust big institutions to protect their privacy, and many just simply want to pay with cash.

Where to begin?

The smart approach is to step back and consider three strategic factors—culture, technology, and behavior—before, during, and after going frictionless. All three factors will influence your success or failure, and it’s important that you keep on an eye on each as you proceed.

Culture. How much do your customers trust you? In all frictionless payment scenarios, your customers must allow you access to their personal data, credit cards, preferences, and digital tracking. They will only do this if they trust you to keep it safe, and if they trust the systems behind it. Think: “Is there some way we can build more customer trust and move them culturally toward a frictionless payments system?” EPAM Continuum takes a user-centric approach to solving these problems, such as our work with the Bank of Jordan, which hinged on the idea of an e-hassalah—a digital version of the traditional Jordanian piggy bank—that converted users’ trust. In a similar way, WeChat Pay initiated the idea of digital payments by introducing digital red envelopes (during the Lunar New Year, Chinese people often give red envelops with small amounts of money to friends and loved ones). Point is: If you don’t have sufficient levels of customer trust in this new form of payment, you may need to find a way to create the conditions for it.

Technology. Frictionless payment systems are complicated, and you don’t want to travel into this world alone. You need to make sure you’re working with the right technology partner here. Dozens of companies exist to usher in this new era, each building out parts of the experience. If you’re interested in talking with us about the technology part of the equation, our parent company, EPAM, is one of the world leaders in tech solutions, particularly in the financial sector. We’ve developed turnkey solutions for Instant Payments. We are looking at how a cashless future can be handled from a technology perspective and we’re preparing for Retail 4.0. The right combination of physical infrastructure in terms of cameras, sensors, and space—along with the critical backend support of security, throughput, and intelligent analytics—is paramount in a successful venture.

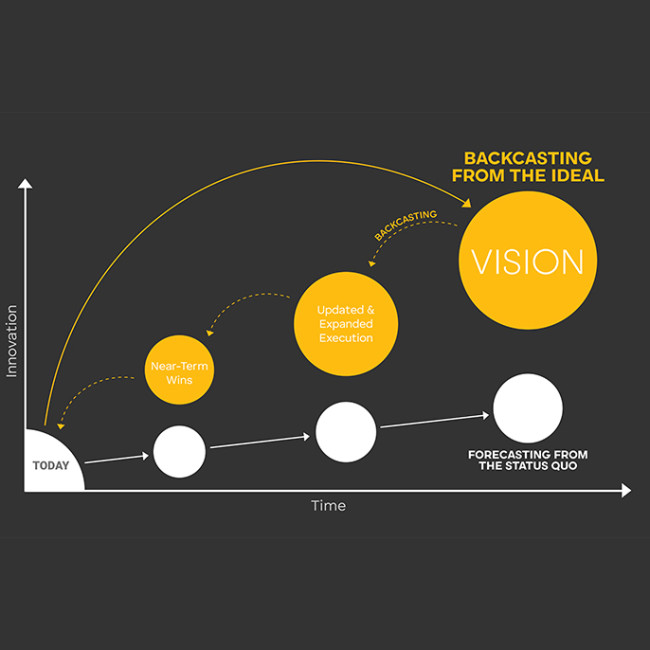

Behavior. Yes, some customers have never used digital payments, and some will flat-out refuse to do so. You need to think of the long-term changes. Behaviors can be changed, given the correct approach, particularly when your target behavior is clear and concise. We employ the model of backcasting to approach solutions: first, we identify the ideal future state that works for all consumers, and then we work backwards to ensure implementation strives for that design intent. Understanding change comes through truly listening to your customers—and meeting them where they are—in order to get where you want to be.

It’s difficult to deny that frictionless is our future. Technology will continue to advance, and the ability to implement these solutions will continue to get faster and easier. But the success of the venture will start with creating a culture of trust, defining the required infrastructure, and helping your customers embody the behaviors you wish to see.

Image by Jessica Maniatis