As we trot into the second month of 2018, let's look at how our New Year's resolutions are holding up. Remember your resolutions? Yes, those resolutions.

Don't feel bad. You're hardly alone. In January, we're all propelled forward by an optimistic gust of seasonal self-reform; by February, life has slowed us down with its domestic chores, endless business meetings, and intermittent snow-shoveling. But that doesn't mean we're excused from the difficult process of self-improvement. We just need some help. We just need the right framework, the right mindset. Turns out, Continuum has just the thing.

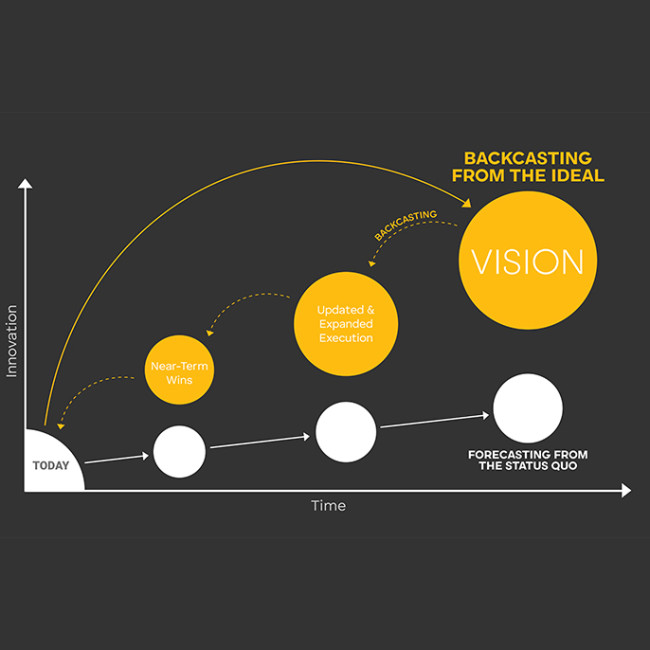

At Continuum, we're experts in guiding our clients as they look to grow through innovative products, services, or experiences. But rather than forecasting ahead one, two, or three years at a time, we have a strategic approach when it comes to building a future vision. We consider what business, cultural, and technological trends might evolve to define the next five to 10 years, and then analyze them alongside consumer values. We cast our line far into the future, and rather than forecast from today, we "backcast" from the future, filling in the trajectory with near-term and long-term products and services that adhere to our future visions. Our backcasting model sets the foundation for future-focused yet pragmatic experiences.

We believe the backcasting model can work for you-and to prove it, we're applying the process to our very own lives.

We believe the backcasting model can work for you—and to prove it, we're applying the process to our very own lives. A small team of our strategists and designers is launching itself into a more physically and fiscally fit future. If you're looking to improve your own life, in 2018 and beyond, read about how our folks took backcasting personally.

Just Start, and Start Now

When it comes to long-term finances, "simply put, women don't invest as much as men do," Sallie Krawcheck, the CEO of Ellevest, writes in Money magazine. "And they don't invest as early as men do, either."

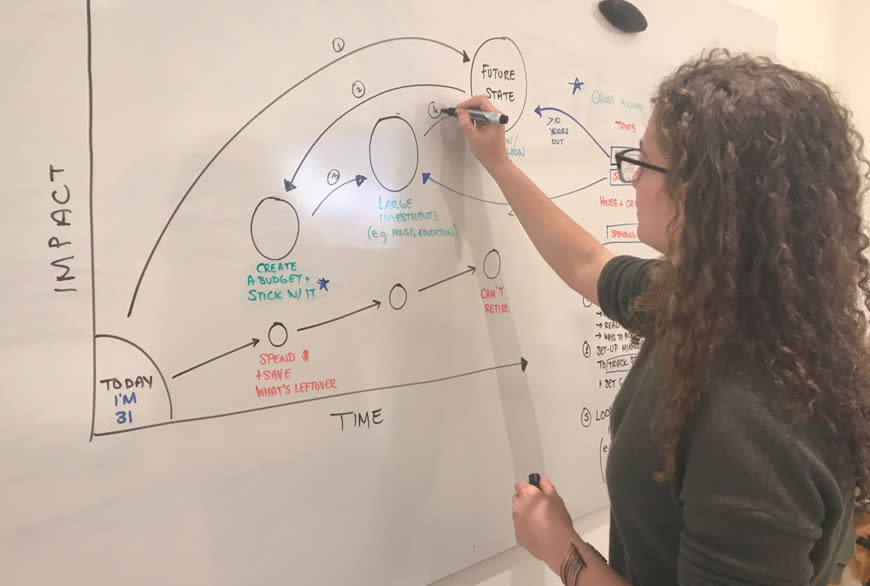

Continuum Strategist Rebecca Pinn is on a mission to change this. Her own financial backcasting path takes her towards being able to retire comfortably by the age of 65. "Warren Buffet says to save first and then spend what you have left, and many do the opposite," says Pinn. "A lot of people start by saving a little, rather than looking at the end goal they want to have." By looking far in the distance, Pinn backcasted across the more than 30 years before she turns 65 to identify the amount she'd need to invest and save monthly, in order to reach her goal. She identified the near-term steps to take now, including tracking her monthly spending on financial app Mint.

"A lot of people start by saving a little, rather than looking at the end goal they want to have."

Even when the future retirement amount seems daunting, she says of the easy-to-follow monthly budgeting, "This part, I can do."

For those who take the opposite approach and look at what they think they can save now, Pinn says: "You end up just not saving anything, and you end up saving too late!" But when you have a number looking at you in the face, you find ways to make it happen—lowering expenses (a reevaluation of your lifestyle) or increasing income (a new job, side gigs, or additional schooling).

By breaking a big goal down into near-term steps, the system has worked, and alleviated some of Pinn's stress about retirement.

"I don't need to often look at the amount in my investment accounts. If I'm following my plan, I know I'll be okay."

Keep the Ideal State in Mind. Anticipate Hurdles, and Leap Over 'em.

Rather than the over-set goal to simply "save more," Associate Designer Luke Hydrick knew he had to be honest with himself to make a big shift in his current personal savings.

To inspire a change in his financial behavior, Hydrick set his ideal savings state at a specific dollar amount: enough cash to sustain him (comfortably) one year.

While he has been successful in constructing a taut financial safety net, Hydrick noticed large fluctuations in the size of his monthly contributions, which made his growth rate inconsistent. To inspire a change in his financial behavior, Hydrick set his ideal savings state at a specific dollar amount: enough cash to sustain him (comfortably) one year. This target would give him the financial freedom to fulfill his long-term dream of taking a one-year sabbatical to travel North America, hiking and camping along the way.

By backcasting, he identified first a yearly savings goal, and then continued to break this down into monthly chunks. Hydrick then identified the specific ways he'd ensure the savings from each paycheck, including automated transfers and cost-cutting activities such as bringing his lunch to work for the entire week and canceling his un-used gym membership.

Hydrick was also able to anticipate potential setbacks and planned ahead for what could affect his plan, such as trips already booked that would pull from savings for flights and accommodations. To offset these expenses, he came up with additional ways to add to his savings, including selling his motorcycle in the spring. With his dream in mind, the daily steps seem worthwhile, even if the trip itself doesn't end up happening. "There's something nice about having the option to do something, even if you don't do it. It's enough knowing that I could take that trip if I wanted to."

Identify the Little Steps that Lead to Big Change

"Going from zero to anything is the hard part. It takes time to give yourself structure, but executing against a simple daily plan you've already made is easier," says Business Strategist Pete Chapin, who set his sights on being in the best shape of his life over the course of a three-year span. "Initially, looking at all you want to accomplish can be overwhelming." Chapin admits that if he did all he envisioned at once, "I'd drop dead in days," and that knowing he has years to reach his goals was "a bit of a relief."

"Going from zero to anything is the hard part. It takes time to give yourself structure, but executing against a simple daily plan you've already made is easier."

Chapin's path to what he calls "rugby greatness" means consistently following the rules, and in order to get there, he knows the near-term goal was to plan to track his behavior. By breaking these states into timed sections, Chapin identified across three categories-diet, exercise, and mindfulness-various ways to meet his ideal state. In the table below, you can see how near-term wins would lead to his expanded execution tasks, ultimately guiding him to the future state where these actions have become habitual.

Knowing he was the type of person to cross "take a shower" off of his to-do list for a sense of accomplishment, Chapin saw the need to identify near-term wins that would show progress and nudge him towards a bigger shift in his day-to-day activities. Seeing how a goal in one area, such as getting to the gym more regularly, would impact another area, like cooking at home, he planned on the trajectory the ways to accomplish both. (Grocery shopping on Thursdays; going to the gym on Tuesdays and Wednesdays.)

To Chapin, the process pushed out his expectations that had failed him in health attempts of the past. "It's better to figure out a plan that works, and get there successfully but slowly, than it is to burn hot at the beginning and then give up or set an unrealistic goal without a way of providing how to go beyond."

By looking at the future and the "why" behind all of these lifestyle changes, Chapin felt more prepared than ever to make this goal a reality.

Your Turn to Make It Real

Envisioning your ideal future state is just part of the process of building a long-term success trajectory. The other part—which is the backbone of Continuum's approach to innovation—is implementation. So go on and make it real. And of course, share with us your own experience on this backcasting adventure.

After all, we're already two months into 2018…