The financial services industry has evolved significantly over the past 20 years. From ATMs to robo-advisors, we have seen financial services innovate their offerings, most significantly from high-touch, expensive, accessible-only-to-the-one-percent services to a series of technology-enabled products that afford ordinary people access to banking services, investments, and asset allocation, so that they can experience better financial lives.

And yet, people still struggle to manage their money effectively. Household debt, for instance, is up from $35 billion to $12.3 trillion, and people are having a harder time living on middle-income wages than ever before in history. Why do people continue to struggle with money despite the development of so many new services to help them more effectively manage it?

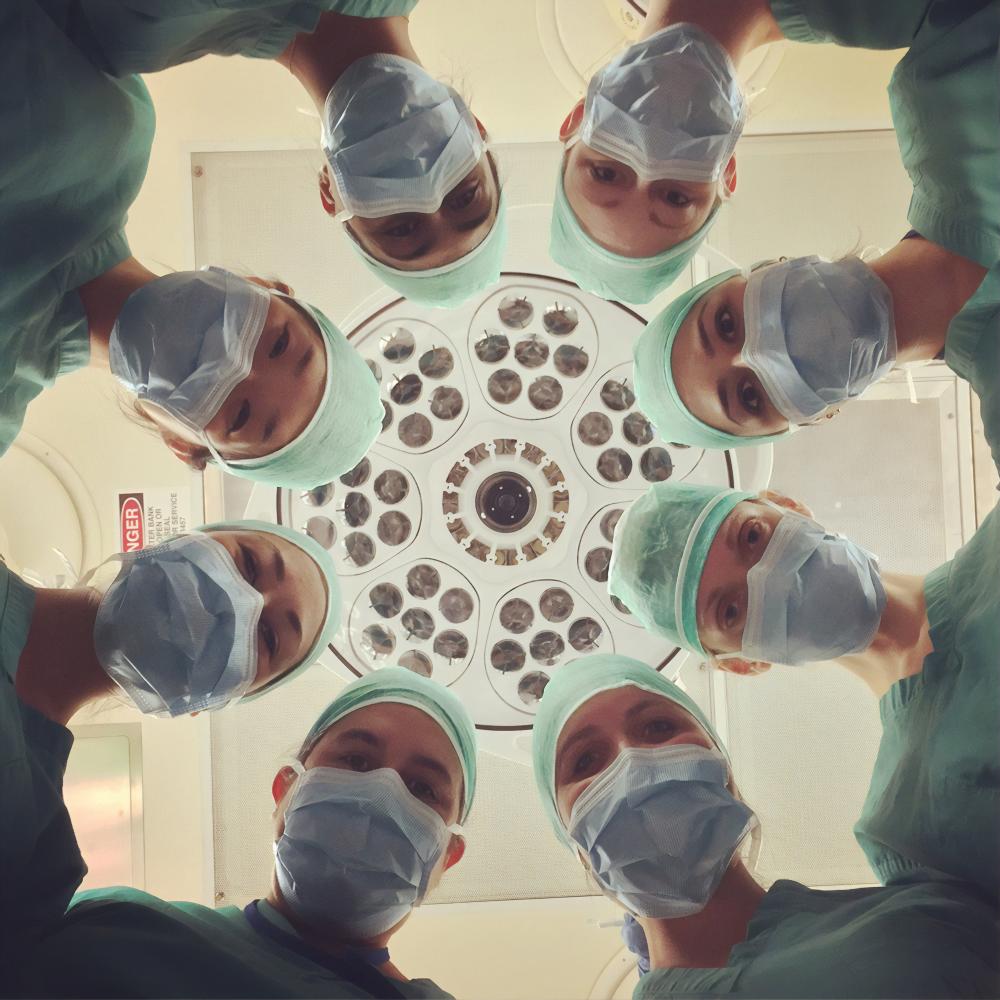

Healthcare has been working hard to help people better manage their health and live longer, more comfortable lives. The question is: What can financial services borrow from healthcare that would help us all better manage our financial lives?

Switch to Value-Based Incentives

Healthcare is moving to a model that rewards improved clinical outcomes for managing a population of patients. It’s a departure from the fee-for-service model, which favors clinical activity, and not necessarily results. Financial services should consider what outcomes its investors are seeking (not just principal protection vs. growth, but goal-based ones, such as “We want to pay for 50% of our kids’ college costs”), and compensate employees for helping clients achieve these goals.

Help People Maintain Their Financial Health

Healthcare figured out a long time ago that treating emergencies is a lot less effective in the long run—and more expensive—than providing good preventive care. When people actively manage their diseases and take care of their health, they can live healthier lives at lower cost. Yet, when it comes to managing money, people living on middle-income wages (and below) need as much financial advice and guidance as anyone, but there’s little financial incentive for advisors to help those who need it the most better manage their money. Without effective financial and investment guidance, consumers can wind up living in a downward spiral of financial despair, putting more pressure on their families while racking up debt and increasing their use of social-support services. Financial services should consider how to help those who need financial advice and access to products that will help them live healthier financial lives, both day-to-day and in the long term.

Move from Buyer-Centric to User-Centric Services

Healthcare focuses on buyers—physicians and hospitals—as the main sources of revenue. They buy most of the products and employ the most people in the system, so manufacturers naturally go where the money is. But we’re seeing a shift towards patient-centricity in healthcare. Manufacturers are focusing more effort on providing better patient experiences. This shift moves the focal point from B2B to B2C in healthcare, and has manufacturers trying to understand patients better and better serve their needs. Financial services should consider not just what financial advisors and brokers desire, but what their clients want and need. The idea of buy-and-bill is moving towards outcomes-based care and, similarly, we should see the decline of incentive-based pay structures for selling financial products, and the rise of compensation structures that reward financial services companies and their employees for delivering the results individual investors need. Let’s learn to drive demand from the end of the very end of the value chain.

Understand that Health and Money Are More Linked Now than Ever

Healthcare and financial services must understand that their industries are connected at the hip. Patients and financial service customers already know this, but most people are still largely left on their own to figure out how to better manage their finances, particularly when it comes to their healthcare. Financial services and healthcare companies should consider how to help people better manage their healthcare dollars, as many are bearing a greater financial burden of healthcare costs through the increasing use of high-deductible plans.

While there are lessons financial services can learn from recent changes in healthcare, some of people’s greatest needs actually exist in the space between the two industries.

Embedded content: https://www.youtube.com/watch?v=bBNMvq1lGsI